The Value of Debt: How to Manage Both Sides of a Balance Sheet to Maximize Wealth: Anderson: 9781118758618: Amazon.com: Books

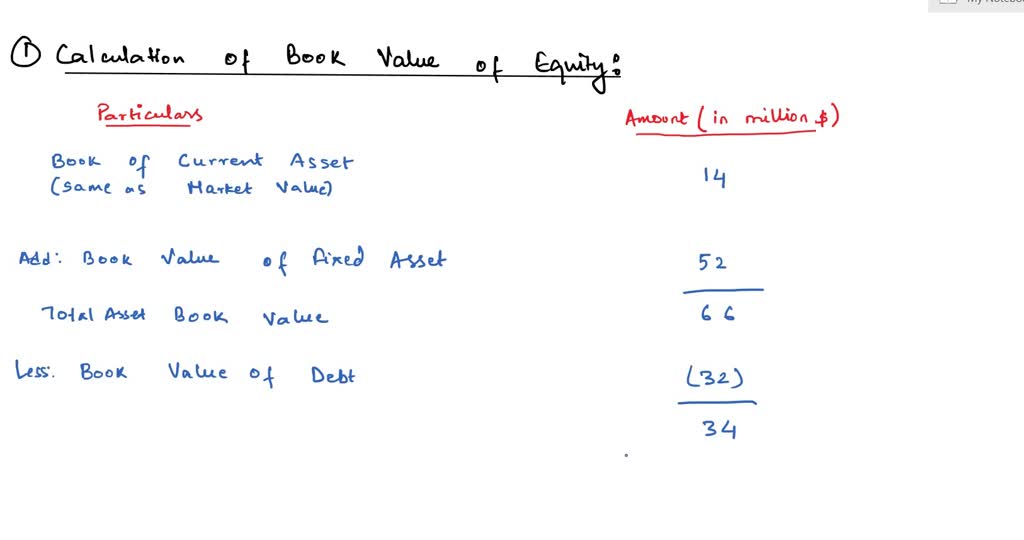

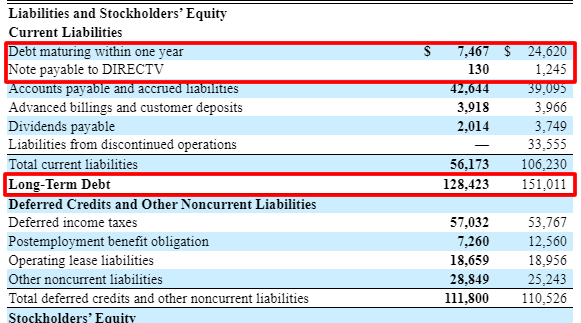

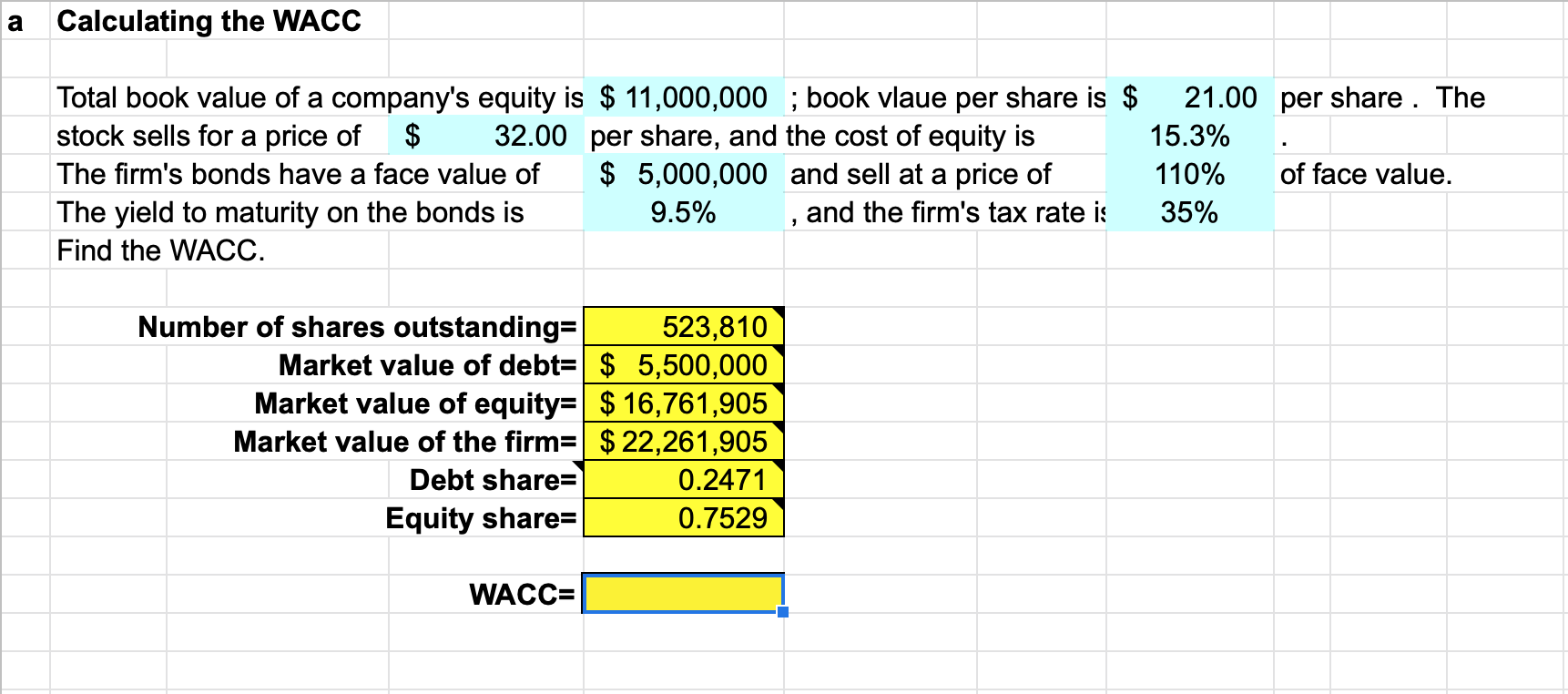

SOLVED: A firm has current assets that could be sold for their book value of 14 million. The book value of its fixed assets is52 million, but they could be sold for

:max_bytes(150000):strip_icc()/book-value-99796d4d1fb44bd4bdc961e6042698d7.jpg)

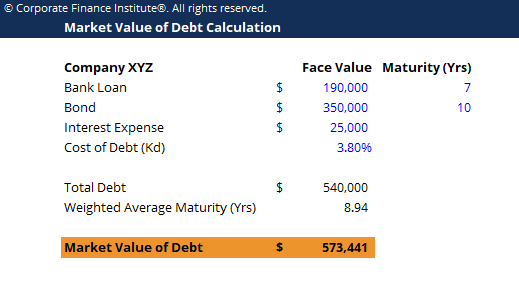

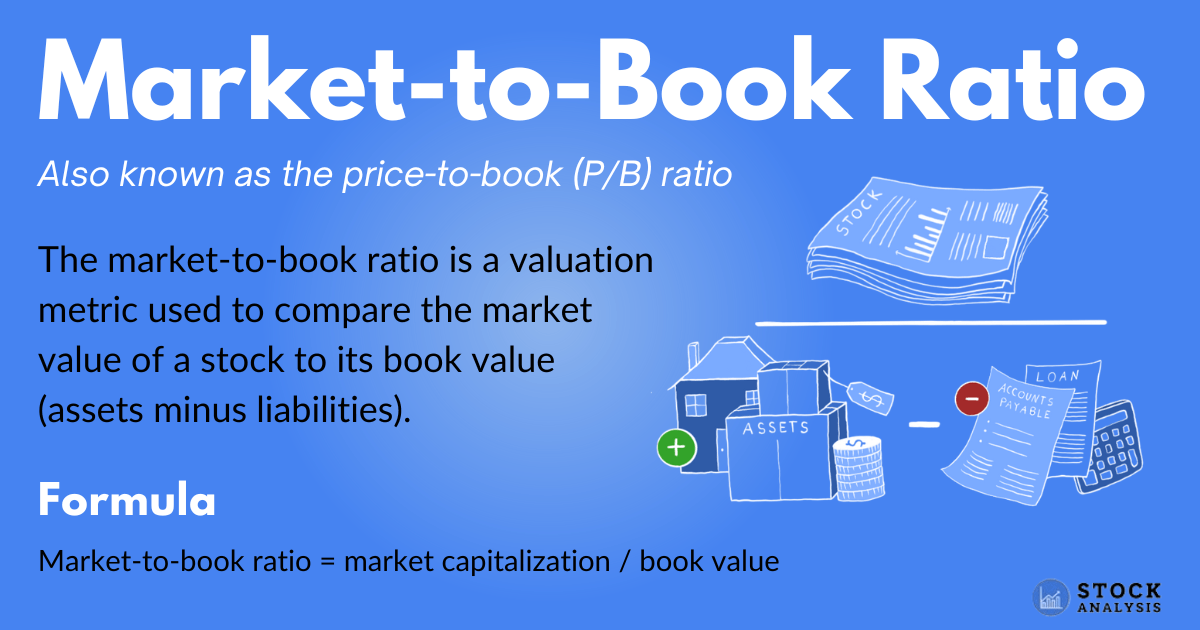

![Market Value Of Debt - [ Definition, Formula Calculation, Example ] - Guide Market Value Of Debt - [ Definition, Formula Calculation, Example ] - Guide](https://www.stockmaster.com/wp-content/uploads/2020/02/market-value-of-debt.jpg)